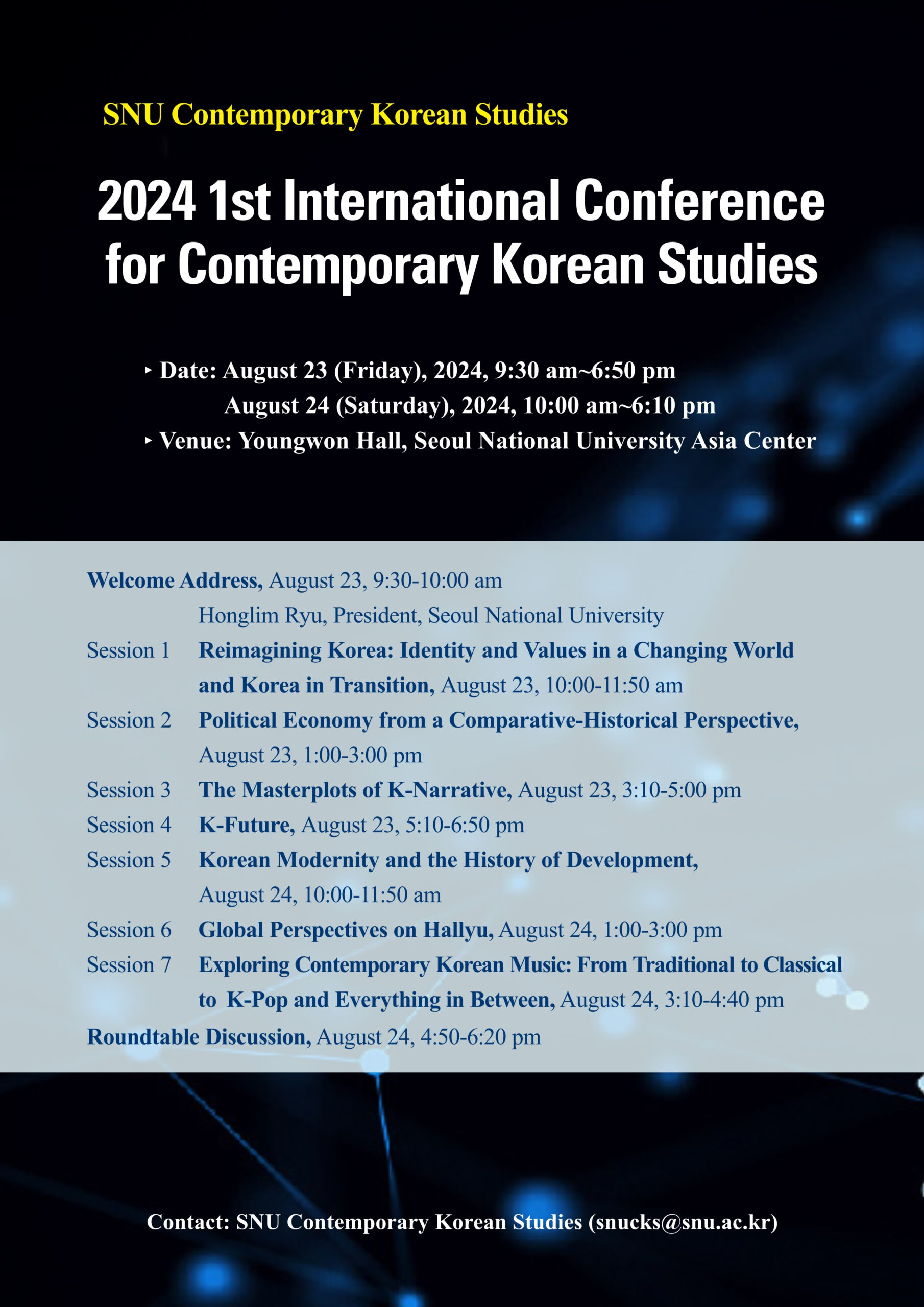

제1회 현대한국연구 국제컨퍼런스(The 1st International Conference for Contemporary Studies)에서 Nathalie Luca의 “What is Optimism?”과 김홍중 선생님의 “Toward a Symptomatology of K-future”에 대한 토론문입니다. 한국의 post-developmental temporality에 대한 논의가 필요해 보입니다.

Discussion: Future as Calculable and/but Open?

I found both presentations incredibly interesting, because they address issues related to the future, temporality, and our affective or psychological responses to these issues. The theme of futurity resonates with my recent research on young Korean cryptocurrency investors and various investment advisory YouTube channels. Given the limited time, I’ll briefly introduce my research under the K-future project and discuss how it connects with the presentations by both professors.

First, I’d like to interpret the survivalism and optimism presented by both professors in relation to Pierre Bourdieu’s discussion of the duality of modern temporality. In his ethnography of the Kabyle people in Algeria, Bourdieu explains how this community had to abandon their traditional notion of time and “learn” the ‘capitalist habitus’ or the temporal disposition of capitalism. He describes this capitalist temporality as the contradictory conjunction of “calculable and/but open”:

The economic agents I was able to observe in Algeria in the 1960s had to learn or, more exactly, reinvent, with greater or lesser success depending on their economic and cultural resources, everything economic theory considers (at least tacitly) as a given…: the idea of work as an activity procuring a monetary income, as opposed to mere occupation on the lines of the traditional division of activities or the traditional exchange of services; the very possibility of impersonal transactions between strangers, linked to a market situation…; the notion of longterm investment, as opposed to the practice of putting in reserve…; the modern conception… of lending at interest and the very idea of a contract, with its previously unknown strict deadlines and formal clauses… These are all so many partial innovations, but together they form a system because they are rooted in a representation of the future as a site of ‘possibles’ that are open and susceptible to calculation (Bourdieu 2005: 4).

In other words, the future now emerges as an empty horizon, calculable through various devices, while simultaneously being regarded as an open and subject to change. As Immanuel Wallerstein says, in modernity, “change becomes normal.” This means that the future becomes both an object of calculation and an object of belief. While this temporality may seem contradictory at first glance, the duality of the future in capitalist modernity seems to be found in various concepts used in capitalist analysis concerning the future.

For example, economist Frank Knight (1921) distinguishes between risk and uncertainty. According to him, risk can be calculated through probability distributions, while uncertainty refers to events that go beyond such calculability. Or John Maynard Keynes (2018[1936])’ distinction between enterprise (investment) and speculation also seems to reflect this division. According to Keynes, investment is based on the evaluation of a company’s past performance and underlying capital, while speculation involves predicting the unpredictable preferences of the market.

Within this theoretical framework, I’ve been examining how Korean investment advisory YouTubers predict and present the future of the financial market. What I find interesting is how these YouTubers combine objective data with fictional narratives. They present various numbers, figures, and graphs to predict the future, but they create stories or narratives around these predictions. On one hand, the prediction of the future is a highly technical discussion, but on the other hand, it’s also close to a myth or what sociologist Jens Beckert calls “fictional expectations.” I am particularly interested in how they combined these two aspects to performatively construct a concrete vision of the future.

I’ll now shift to commenting on both professors’ presentations. What struck me during today’s discussion is that the themes of survivalism and optimism are also found in YouTube investment advisory channels and among the South Korean young investors I have interviewed. Here, survivalism manifests as a form of “존버” (“HODL” Hold On for Dear Life), and optimism as “떡상” (dreaming of a “moon shot”, or dramatic price increase).

While survivalism and optimism may seem opposed, I think they are actually two sides of the same coin. In both survivalism and optimism, there is an element of ‘waiting’ and ‘endurance’, which suggests a peculiar form of agency (or rather “patiency” to borrow Professor Kim Hong-jung’s concept). The future becomes a space for survival where the present continues because it is calculable, but at the same time, it is a space of dreams and beliefs because it remains open.

Perhaps this peculiar combination of survivalism and optimism is best captured by Lauren Berlant’s famous concept of “cruel optimism.” Berlant describes ‘cruel optimism’ as “a relation of attachment to compromised conditions of possibility whose realization is discovered either to be impossible, sheer fantasy, or too possible, and toxic” (Berlant 2011: 23). In other words, it refers to an affective response to a reality where only the ideal and the myth of a “good life” persist, while the conditions and calculability to achieve it are gradually crumbling.

In my previous research, I have described this combination of survivalism and optimism, or ‘cruel optimism,” which is particularly evident among South Korean youth, as “post-developmental affect.” (Lee 2018). Post-developmental affect is an affective response to a situation where the “developmental ideal”–that younger generations will live more prosperous lives than previous generations–continues to prevail, but the material and practical foundations of rapid economic growth are collapsing. A young person I interviewed during my fieldwork research compared this situation to running hard on a treadmill while the treadmill itself is gradually slowing down. So I will conclude my discussion by quoting directly from this interview:

“Objectively speaking, today’s society might be more affluent than ever. But I think that in the past people could build a plan for an ‘ordinary life’ [p’yŏngbŏm-han sam, 평범한 삶], when to buy a home, get married, and have a baby. For our generation, it’s simply impossible to think out our future because having a stable job is just out of reach for most of us. So we feel like we’re doomed from the starting line. We are the most educated generation ever and still making a lot of effort, but society does not reciprocate our efforts any more. It’s like, (pause) if you were to continue running fast on a treadmill while it slows down and stops, you would lose control and eventually fall off the treadmill, right? I think that’s our generation’s situation. That kind of sense of unease and instability keeps haunting me and us.”

References

Berlant, Lauren (2011). Cruel Optimism. Duke Univ. Press.

Bourdieu, Pierre (2005). The Social Structure of the Economy. Polity.

Keynes, John Maynard (2018[1936]). The General Theory of Employment, Interest, and Money. Palgrave Macmillan.

Knight, Frank (1921). Risk, Uncertainty, and Profit. Houghton Mifflin.

Lee, S.C. (2018). The Social Life of Human Capital: The Rise of Social Economy, Entrepreneurial Subject, and Neosocial Government in South Korea. Ph.D. Dissertation. Columbia University.